One of the most common questions I’m asked by individuals with regards to investing in mutual funds is, “Where should I even start?” With the countless fund companies, fund families, asset classes or exposure to different sectors of the economy, it’s no doubt that some investors might have trouble deciding where to start or how to even evaluate a fund once they’ve found one. Everyone will have a recommendation, especially an advisor, but how do you determine if the fund is right for you?

Two great websites I recommend as a starting point for mutual fund data are http://www.morningstar.ca/ & http://www.globefund.com/. They both have advantages and disadvantages, but the information and tools available at both with help you to sift through the necessary information to make a more informed decision.

If you’ve read “Building an Investment Portfolio” and you’ve completed each step, then you may be ready to proceed with this process. To start you want to choose an asset class – examples: Fixed Income, Canadian Portfolio, US Equity, International Equity, etc.

The first step is simple: compare funds within the same category. The “Canadian Portfolio” category on morningstar.ca has a listed 510 funds. It’s important to realize that I’m not suggesting you look through all 500+ funds to get a sense of what’s out there. Instead, you can use the search function on either site to browse through the menu choices in order to get a sense of the category as a whole. Familiarize yourself with the information there and get yourself comfortable with the terms that I’ll focus on specifically.

Out of all those funds, you may choose only 5-7 funds to start. In my opinion an early mistake many investors make is moving right to the “performance” section to see what returns the fund has provided over the past few years. Although performance is important, I’m writing this to help you adopt a critical thinking process on how to approach funds.

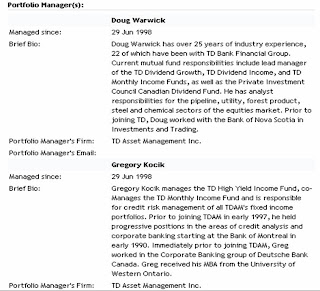

What I like to look at first is Management and Costs. My reasoning is very similar to that of including management as one of my value rules: if you’re going to pay someone to handle your money, you want to make sure they’re qualified & experienced. Many portfolio managers have biographies or a brief description of their work experience both with their current fund company or any past employers. What I’m looking for a manager or group of individuals who have direct experience & education in the sector the fund concentrates on. If a manager has spent his entire career managing fixed income securities, it doesn’t make much sense for him to now take on responsibility of a stock portfolio without any experience in doing so. What I’m essentially looking for is the manager’s competence, habits, history and what value for my money am I’m willing to pay for his expertise.

All mutual funds charge an MER (management expense ratio) as well as regular management fee which may or may not be included in the MER. This fee usually involves all costs including the trading costs the fund generates by buying & selling securities, the salary of those involved, as well as a fee the company generates to make their own money. My belief is that performance is directly related to cost & risk. Since this is your money – you want to get value for what you’re paying for. I myself am willing to pay a conservative premium for a manager who has consistently shown he can beat his/her respective benchmark over a period of time or has knowledge of an industry or geographic sector I myself do not. That being said, I have never paid a MER over 2.5% for any fund and very rarely pay over 2%. I’m also not a fan of funds that charge front or back-end loaded fees. I have a strong preference to funds that are no-load and I’ve never paid a fee or commission to purchase except for a few Saxon funds I’ve owned.

An investor should also take the time to read the objectives of the fund & management in order to get a good feel of what to expect both for returns and what types of companies the fund may buy or sell depending on how they select securities. An example of this would be something like:

“Seek to provide a consistent level of monthly income with capital appreciation as a secondary objective, by investing primarily in income-producing securities” or “Achieve long-term capital growth similar to the performance of one or more generally recognized international equity market indices…seeks to eliminate substantially foreign currency exposure.”

This is either the fund company or manager’s opportunity to clearly state what their intentions are if you choose to invest in the fund. The fund may also have a section on “Why Invest” or “Recommended For” in the hopes of attracting or discouraging the right or wrong type of investor for the fund.

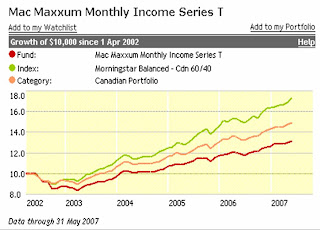

Every fund will also be benchmarked against a certain index in order to evaluate its returns on a broad basis. A benchmark is simply an index or category that is used to examine a broad collection of securities from a sector, region or country. Examples could be the TSX Composite, S&P500, MSCI EAFE or something similar to the Morningstar Balanced 60/40. It’s important to look at how a fund tracks an index, benchmark & category in order to get a sense of what premium you’re willing to pay for the funds performance. If a fund follows an index exactly over a period of time, then the manager is not adding any value to the fund in comparison with holding a security that simply follows that index (ETF/Index Fund).

You also want to get a sense of whether the fund’s benchmark is appropriate for the fund. What you wouldn’t want is a fund based on a specific sector that has a benchmark comprised of completely different securities. I also look to see how the fund performed vs. the benchmark both in up & down markets. Many funds will under perform when the market is hot, yet the manager’s value may be seen instead when the markets are down and suffering. A fund manager may add value in a bear market that no index exposure can. Although you may sustain a loss, it may be minimized in comparison with the benchmark. I also look for a fund that traditionally moves away from the benchmark or suffers less volatility over the short & long term. If the fund consistently beats its benchmark, then you can justify what premium you’re willing to pay to invest in that fund compared to the index or benchmark. You may also choose to compare the fund against other funds in the category & see how it measures up against the category average (what other managers avg. returns are).

Asset, Geographic and Sector allocations are also something you may want to take a look at to help you evaluate a fund. The importance here is a fund you choose might not fit the objectives of your portfolio specifically. If you’re looking for a fund solely for exposure to emerging markets, yet the fund holds a significant amount of Canadian exposure, this might not fit your objectives or what price you’re willing to pay (MER). Looking at the sector breakdown may help you decide whether the fund is exposed too much or too little to a sector you desire to be exposed to.

Examining the currency exposure of a fund may also be a top priority here. Whether a fund invests completely in US$, CDN$ or a blend of other currencies may put the returns of the fund at risk depending on if the value of those currencies rise or fall. A good example of this would be the difference between a strict index or a currency neutral version of the same fund & holdings.

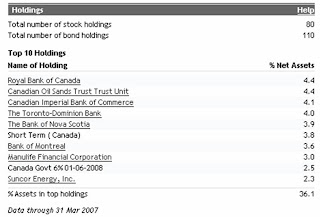

The holdings section is also very important to examine. Most funds disclose their top 10 holdings which give you a rough idea of what the fund is comprised of. The important thing to look at here is how much of the entire portfolio is comprised of those 10 holdings. A fund which holds 90% of its portfolio in 10 names may be exactly what you’re looking for or be heavily exposed to 10 names which you suspect aren’t what you want. If the top 10 only comprise 50% of the entire fund, you may want to look at the entire prospectus from the fund company to see exactly everything that it holds so there are no surprises.

It’s important to realize this is only a starting point, what I’ve mentioned may or may not fit your needs and there are certainly many other tactics you can use to help you select what funds are right for you. But in my own experience and what I recommend to others, I feel that these factors play a very important role in helping an individual choose which mutual fund fits their needs best. Once you’ve selected how you want your portfolio to be organized involving asset allocation, security selection & geographic allocation, picking the individual funds to help you achieve that may be a time consuming activity. Yet, spending the right amount of time and understanding the funds you’re choosing will go a long way in helping you to fit the proper proportions into your portfolio.

I will be examining the Morningstar X-Ray Tool in a later post to put this all into a better perspective.

Seriously dude, you’re planning on posting the competition on here? The guys at work will harass me to no end if you start that sh@t. You suck.

But seriously > its a damn good site. I keep telling the Croc that he needs to read this stuff.

Hmmm….is someone starting to get a little nervous?